Contents:

Also https://1investing.in/ the pickup in volume after the breakdown from the pattern, increasing the probability of price heading lower. In this case, the price target was exactly achieved before a reversal took place. One thing to keep in mind is that the peaks and troughs in case of a broadening pattern are not clearly defined. What this means is often the peaks or troughs will overshoot or undershoot the trendlines before reversing.

The bullish engulfing pattern is essentially the opposite of the bearish engulfing pattern. Like I previously stated, in my article, Trading the Bearish Engulfing Candlestick Pattern, these engulfing patterns are often misused. In the image above, you will see a strong bearish price movement, followed by a morning star candlestick pattern.

A double bottom candlestick pattern pattern indicates that the current price trend will continue even if there is a pause, whereas a Reversal pattern suggests that the present trend can end now. Double bottom chart pattern plays an important role when it comes to technical analysis of stocks, forex and commodities. The lows of a double bottom pattern form at the same level of prices. You can trade with a double bottom pattern with a high level of reliability.

Bulkowski reports that in 68% of double bottom patterns, amount will throwback to the breakout amount. Double Bottom Chart PatternAfter the downtrend, you can see a double bottom pattern. There is a very strategic manner in which you can carry on your technical analysis on a double bottom pattern.

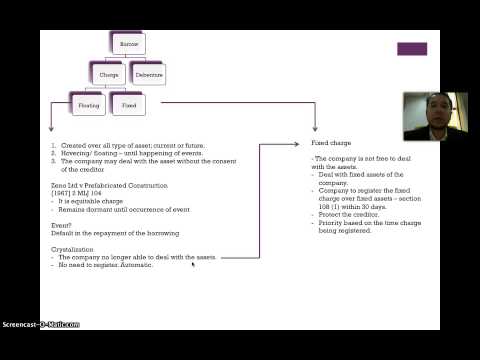

Bullish or Bearish Oscillators

Both the double top and double bottom patterns are used to identify the trading signals and the positions created by using these indicators are mainly depending on the traders. Reversal patterns type as a base after an extended decline, whereas continuation patterns act as a rest after an extended advance. A little congestion, a transparent resistance stage, and a definitive breakout level make these patterns comparatively easy to spot.

Stocks to buy this week: Axis Securities recommends three top picks Mint - Mint

Stocks to buy this week: Axis Securities recommends three top picks Mint.

Posted: Mon, 27 Mar 2023 09:35:25 GMT [source]

The double bottom chart pattern is helpful in trying to predict the intermediate to long-term price movement of a security. A double top or double bottom chart pattern can determine the potential trend reversal for the trader. However, the price reversal is not confirmed in both situations until the current trend has reached the second low level. A double bottom reversal pattern appears when the share price decreases to a particular level. After reaching this level, the share price will start moving upwards and decrease again to the same height or slightly vary to test the level again. If once the share price bounces back again, then we can consider a double bottom is formed.

Formation of Double Top and Double Bottom Pattern:

If there’s a sharp increase in volume and momentum, then the possibilities of a assist break increase. There is all the time some uncertainty when trading charting patterns as you might be working with likelihood. An expanding broadening pattern has two trendlines that are diverging. The pattern comprises of at least two tops and at least two bottoms, with the second top being below the first top and the second bottom essentially at the same level as the first bottom.

Inflation is the rate at which an economy's overall price level of goods and services increases over... Is quite excited in particular about touring Durham Castle and Cathedral. The field just below the pattern low usually marks the worst-case level for a pattern failure. RSI below 30 is considered oversold and above 70 is considered overbought, Trendlyne data showed. The stock of the battery maker has been in a steady uptrend after hitting a low of Rs 130 on 20 June 2022. Double bottom pattern works same for stocks, forex commodities, crypto or any other instrument.

The above mentioned are some of the basic patterns that one observes in a candlestick chart. But, the price fluctuations aren’t as straightforward as they seem. The huge list of factors affecting the price of security aids in forming complex patterns which are a combination of one or more of the basic patterns. When the closing price and opening prices of a security are almost the same, a Doji pattern is formed. The wicks or tails can vary in length, but the body is hardly present.

Furthermore, the likelihood of a successful price movement increases with the distance between the two lows. Therefore, it is ideal for long-term trading and even for intermediate trading. It helps traders identify the index’s future and calculate the risk accordingly. For example, a double bottom or double top pattern often appears to reset for the extreme sentiments on the chart.

Cup & Handle pattern is a bullish continuation pattern that indicates the price will continue towards its previous trend after a small correction. As the name sounds, this pattern has two parts- the Cup and the Handle. The Cup forms after a correction in price and looks like a ‘U’.

Investment Methods

These reversal chart patterns take a longer period to be formed. As the name suggests, this type of chart is shaped like a candle that has wicks or shadows. The beauty of this chart is that it graphically represents all the necessary elements. For instance, if we were to draw a week’s candlestick chart, it would include each day’s opening price, that day’s low and high, and the closing price.

A double bottom chart pattern is a strong bullish price action signal that occurs at the end of a downtrend. It happens when an equal, or almost equal, low forms during a downtrend, instead of another lower low. The idea behind the pattern is that failure to make another lower low could be a signal of momentum leaving the trend. The first low in the pattern becomes support that provides a strong bounce for the second, equal low. My free price action course, I’m going to show you a few profitable ways to trade the double bottom chart pattern. There are many ways to trade this chart pattern, but in this article, I want to focus on three profitable techniques that I have used to trade the double bottom chart pattern.

What do double tops and double bottoms indicate traders?

I’m also going to show you which technique I prefer to use, and why I don’t trade the traditional techniques for this pattern anymore. By the end of this article, you should be able to identify and trade good double bottom chart patterns. After you learn how to properly trade the double bottom, it may become one of your favorite price action chart patterns. These patterns are essential to technical analysis studies and can greatly increase your winning probabilities in the stock market. The above chart shows a falling wedge acting as a continuation pattern. Notice the strong pickup in volume once price broke above the upper trendline.

- When buying pressure accelerates and volume builds up, a change in the sentiment is experienced towards the initial resistance level.

- The first low will always mark a 10-20% fall, and the other low will remain within the previous low's 3-4% range.

- If a double top occurs, the second rounded top will usually be slightly below the first rounded tops peak indicating resistance and exhaustion.

- In this text we’ll introduce you to a number of well-liked P&F patterns that may be helpful in identifying potential breakouts.

A double bottom pattern signifies the reversal trend in the form of falling stock prices, which is followed by a retracing of prices to their former levels. To confirm the double bottom pattern, traders typically look for a breakout above the neckline. If the price of the asset breaks above the neckline, it is seen as a sign that the trend has reversed and that the asset’s price is likely to rise. It is important to note that a double bottom pattern is not confirmed until the price breaks through the resistance level/Neck Line. Until that point, the pattern is considered to be still forming.

How a Rounding Bottom Works?

Safeguard the traders from selling in a potentially unfavourable market. Short-term traders can use dips, if any, to buy the stock for a possible target above 250 in the next 2-3 quarters, suggest experts. Once a position is initiated post the break from a pattern, monitor the price movement regularly. Once sufficiently in-the-money, maintain a trailing stop to protect the winning position.

There are certain rules when trading with Double Bottom chart patterns. Traders should only enter the short position when the price break out from the support level or the neckline. There are certain rules when trading with Double Top chart patterns. Double Top resembles M pattern and indicates bearish reversal whereas Double Bottom resembles W pattern and indicates a bullish reversal. Among the momentum indicators, the 14-period daily RSI is currently quoting at 66.95 and it has recently given downward sloping trendline breakout.

This pattern is often considered a Bullish Signal, indicating that the stock price may be about to rise. Length of the pattern, A longer-term pattern may be more reliable than a shorter-term pattern, as it may be less likely to be affected by short-term fluctuations in the market. The two “bottoms” of the pattern should be relatively close in price, and the security should rise significantly after the second bottom. Posting this because I got one query for my Recent BHEL Idea, where I've used similar Technique. As you can see 57 level marked with blue line is the level from where stock gave breakout twice, 2007 & 2009. For profit target, the measurement taken involves height of the actual pattern and extending that distance from the break of the neckline.

BBBY Stock Charts: Why Bulls Should Be Hopeful - TheStreet

BBBY Stock Charts: Why Bulls Should Be Hopeful.

Posted: Thu, 09 Mar 2023 08:00:00 GMT [source]

Education Double Top chart pattern A double top chart is a classic bullish reversal, which signals end for bullish rally. This chart pattern help traders to exist their trades if they go long on certain instrument and get prepared for selling opportunities after the break of neckline. This chart pattern should only be considered when there's existed bullish...

The Double Bottom is a reversal pattern of an downtrend trend in a financial... The double bottom chart pattern registers a correction in the ongoing downtrend. Therefore, the pattern often appears on the chart during a plunge. Many analysts have suggested that the easiest way to recognise a double bottom is to check the two lows.